RBA interest rate

The Reserve Bank of Australia is under pressure to end its interest rate hikes at todays meeting amid fears the economy could go into a recession. The RBAs key interest rate is now at its highest in more than seven years.

Rba Cuts Interest Rates By 15 Bp To Record Low 0 1 Teletrader Com

At the time the cash rate target was 01 per cent and it is now 235 per cent and Mr Lowe plans to raise the rate even more in coming months.

. For further information about the cash rate. This is the sixth time the central bank has hiked the cash rate in as many months since it was at a record low 01 per cent in April. Taking the annual rate up to 54 per cent.

Westpac also now expects the cash rate to get. RBA cash rate Are interest rates going up or down. The RBA has been lifting interest rates to slow inflation which at a monthly level has reached its fastest pace since the 1990-91 recession.

Reserve Bank of Australia RBA board members come to a consensus on where to set the rate. Stay on top of the RBAs monthly cash rate decisions with predictions and insights from 40 experts. Lower rises expected for the rest of the year economists say with the possibility of a pause in the longer term.

Traders watch interest rate changes closely as short term interest rates are the primary factor in. RBA For more details see Statistical Table F6 Housing Lending Rates and Statistical Table F7 Business Lending Rates. RBA governor Philip Lowe.

Cash Rate Target. The RBA also publishes a cash rate total return index TRI since May 2016 as a complementary backward-looking benchmark based on the cash rate. The cash rate is currently at 26 per cent which means it could be above 3 per cent by Tuesday.

Look back on Tuesdays developments. A cash rate of 335 implies that household interest payments as a percentage of household income peak below the level reached in 2008 Ms Bullock said the RBA board will closely watch how households respond to the combination of rising interest rates and prices as it decides how high and fast to raise the cash rate. A Includes loans at variable and fixed interest rates Sources.

Interest rate benchmarks are widely relied upon in global financial markets. It comes as the latest interest rate rise means borrowers will see a staggering hike to their mortgages when compared to May. The RBA cash rate affects the interest rate banks charge their customers as well as the rates of interest paid on savings accounts and term deposits.

Prior to December 2007 media releases were issued only when the cash rate target was changed. Monetary policy decisions involve setting a target for the cash rate. On an average 500000 loan yesterdays decision resulted in an.

The Reserve Bank of Australia RBA has hiked interest rates by another 025 per cent bringing the official cash rate to 260 per cent. The Westpac Life total variable rate with bonus interest has increased by 050 per annum to 235 per cent while the Westpac Bump Savings total variable rate with bonus interest has also risen to. All four big banks have taken action after the RBA hiked interest rates for the sixth month in a row on Tuesday.

Importantly lenders dont use the current interest rate on that loan in that calculation but an interest rate at least 3 percentage points higher than the current rate. It was at the historic low of 01 per cent until May. The RBA has raised interest rates for five months in a row now.

Westpacs chief economist Bill Evans said he expected the RBA board to raise the cash rate by 50 basis points in November for a terminal rate of 385 per cent by March revised up from 36 per. The Reserve Bank of Australia RBA opted to slow the pace of interest-rate hikes citing growing risks to households minutes of the central banks October meeting showed. The RBA has now lifted its benchmark interest rate by 175 percentage points since its first rate rise in May with the cash rate target sitting at 185 per cent.

Philip Lowe the RBA governor said the central bank remained committed to returning inflation to the 23 range. Thanks to many current and former colleagues at the RBA whose research on housing prices I have drawn on including Tom Cusbert Calvin He Ross Kendall Gianni La. The board noted rates had already risen by 250 basis points since May and much of that had yet to feed through into mortgage payments.

Its the RBAs most aggressive series of rate rises since 1994 when the cash rate went from 475 to 75 per cent in the space of. Despite this markets have priced in another. They are referenced in contracts for derivatives loans and securities.

The Reserve Bank of Australia has hiked interest rates for the sixth month in a row but by only half the size of the previous five raises lifting the cash rate by 25 basis points to 26 per cent. For an owner-occupier with a 500000 debt at the start of the hikes and 25 years remaining on their loan the total increase to their monthly repayments could be. The Reserve Bank lifts interest rates for the fifth month in a row taking the cash rate to 235 per cent a seven-year high.

Prices went up 25 per cent over the past two years. UPDATED Interest Rates Aussies facing 9k mortgage hike. Interest rates rise again as Reserve Bank lifts cash rate to 26.

If the RBA increases the cash rate by just 025 per cent their repayments would rise by approximately 74 a month with a total increase from the start of May to October of 687. A media release is issued at 230 pm after each Reserve Bank Board meeting with any change in the cash rate target taking effect the following day. Eleven times a year the Reserve Bank of Australia RBA meets to decide whether the cash rate should go up down or remain the same a decision which affects millions of Australians.

Analysis Rba Sends Up Interest Rate Flare Let S Hope It S Seen Worldnewsera

Aud Falls As Rba In No Rush To Hike Interest Rates

Reserve Bank Decision Time Good Luck Australia

Rba Meets On Australia Interest Rates Foreign Brief

Rba Cuts Interest Rates Again By Brad Kirwan Medium

Reserve Bank Interest Rates Rba Lifts Official Cash Rate To 0 35 In First Rise Since 2010 Interest Rates The Guardian

Big Bets On June Rba Rate Rise May Not Pay Off Former Rba Economist Says

Rba Interest Rates Nab First Out Of Blocks As Rba Slows Pace Of Rate Rises

Interest Rates Update Rba Lifts Rates For The Sixth Month Forbes Advisor Australia

Rba Hints More Interest Rate Cuts Could Be Coming

Are The Rba S Interest Rate Cuts Doing More Harm Than Good Money Management

Rba To Hike By Another Half Point In September Slower Pace Of Tightening Ahead Reuters Poll Reuters

Rba Cash Rate Cut Hits All Time Low What This Means For You

Rba Interest Rates Reserve Bank Raises Official Rate To 2 35 Amid Inflation Fears Interest Rates The Guardian

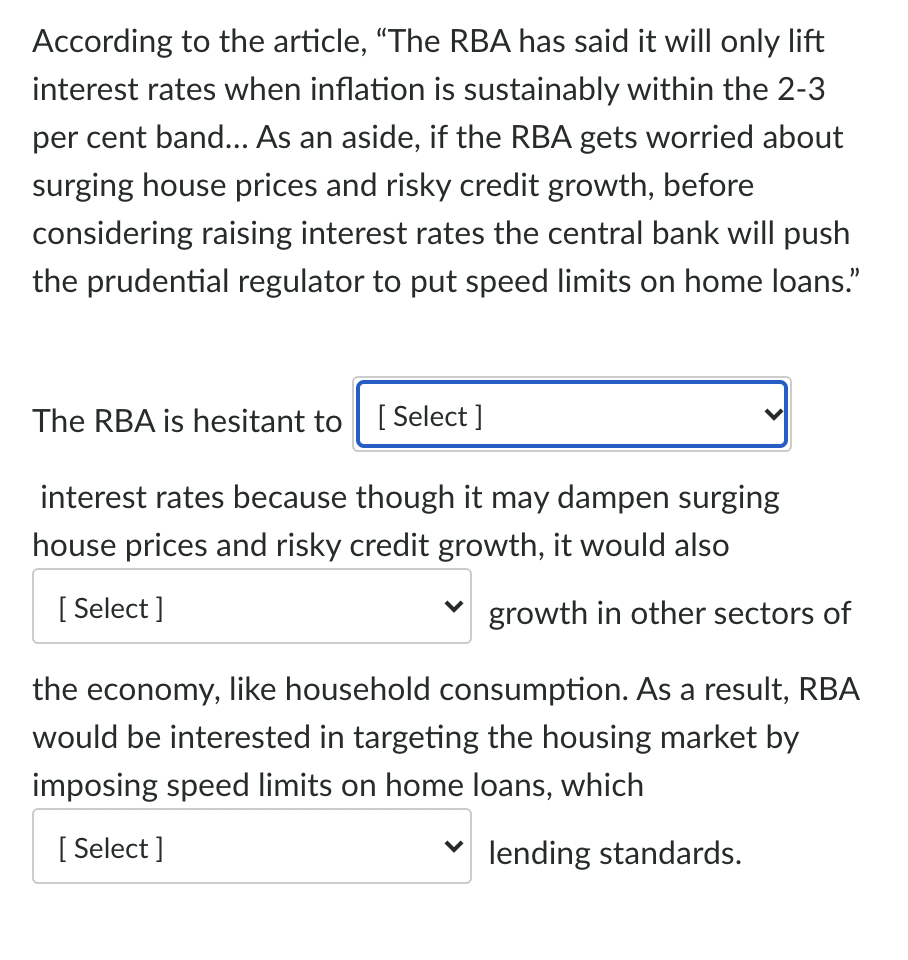

Solved According To The Article The Rba Has Said It Will Chegg Com

Christopher Vecchio Blog Central Bank Watch Boc Rba Rbnz Interest Rate Expectations Talkmarkets

Australia S Central Bank To Cut Bond Buying Rates Left At Record Lows